FAQs

Most frequent questions and answers

Cryptocurrency is a digital or virtual currency that uses cryptography for security and operates independently of a central bank.

Our groups offer insights into market trends, on chain analysis, trading strategies, risk management, and provide real-time signals to aid your trading decisions.

Select your preferred platform from our ‘How to Join’ section and follow the provided link to become a member.

You can begin trading with as little as $10 to $20. Start small to understand the market dynamics, and as you gain experience, you can consider increasing your investment. This approach allows you to learn and grow your trading skills without significant initial capital.

Signals are given when a perfect setup is spotted.

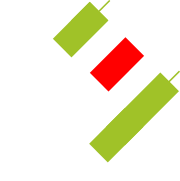

How to Execute a Spot Trade?

Spot trading involves buying or selling cryptocurrencies at their current market price. Here's how to get started:

Select a reputable platform like Binance, Coinbase, or Kraken.

Complete the registration and necessary identity verification.

Add fiat currency or cryptocurrency to your exchange wallet.

Select the trading pair you wish to trade (e.g., BTC/USDT).

- Market Order: Executes immediately at the current market price.

- Limit Order: Executes at a specified price or better.

Once executed, the cryptocurrency will appear in your exchange wallet.

Spot trading is straightforward and suitable for beginners seeking direct ownership of cryptocurrencies.

- Pick a Platform: Use exchanges like Binance Futures, Bybit, or Kraken.

- Set Up & Fund Account: Register, verify, and deposit USDT or another stablecoin.

- Choose Contract: Select a crypto and type (perpetual or fixed-term).

- Go Long or Short:

- Long: If you think price will rise.

- Short: If you think price will fall.

- Long: If you think price will rise.

- Set Leverage: Choose your risk/reward multiplier (e.g., 5x, 10x).

- Place Order: Use market or limit order.

- Pick a Platform: Use exchanges like Binance Futures, Bybit, or Kraken.

- Manage Trade: Monitor position, set stop-loss & take-profit.

Note: Futures are risky—best for experienced traders.

- Pick a Crypto: Choose a long-term asset.

- Set Amount: Decide a fixed investment amount.

- Choose Frequency: Invest weekly, bi-weekly, or monthly.

- Automate: Use tools or exchange features.

- Stick to the Plan: Keep investing, no matter the market.

DCA helps reduce emotional decisions and smooths out market volatility.